The Race for the Best Running App is On

Strava just acquired Runna. But this move isn’t just about product features. It’s about user behavior, market dominance, and what drives people to commit.

Health & Fitness is in.

From sport apparel becoming more luxurious and technical, to exercise being promoted as the ultimate form of self-care, and running clubs emerging as a new way to socialise, we’re seeing a growing interest in sports overall.

This boom coincides with the loneliness epidemic and the decline of traditional community activities, especially as many new runners picked up the habit during COVID.

Over the past few decades, the number of runners has exploded. In 2024, the NYC Marathon officially broke the world record for marathon finishers. Marathons have also become more inclusive since women were first allowed to compete in the 1970s.

Running is the fastest-growing sport globally, and Gen Z appears to be seeking community and connection through it, according to Strava’s Year in Sport data. In 2023, women were also more likely to upload runs than men on Strava.

So while interest in running keeps climbing, one of the biggest industry moves just dropped: Strava has acquired Runna, the running app.

Health & Fitness apps are in

Running is on the rise. Since COVID, fitness and workout apps have consistently grown in popularity, with downloads increasing year after year. January is typically the peak season for these apps, as New Year’s resolutions kick in. COVID really accelerated the shift to digital fitness, from YouTube workouts to high-quality apps. We saw the biggest spike in January 2021, with downloads jumping over 30% YoY. According to Statista x AppMagic, in January 2025, leading fitness apps hit over 25 million downloads worldwide, nearly matching the 2021 record.

Health & Fitness covers a wide range of use cases: calorie counters, period trackers, food scanners, blood pressure monitors... and of course, running apps. In January 2025, out of the top 10 fitness & sport apps worldwide (by revenue, iOS + Android), two were running-focused: Strava (#2) and Runna (#8).

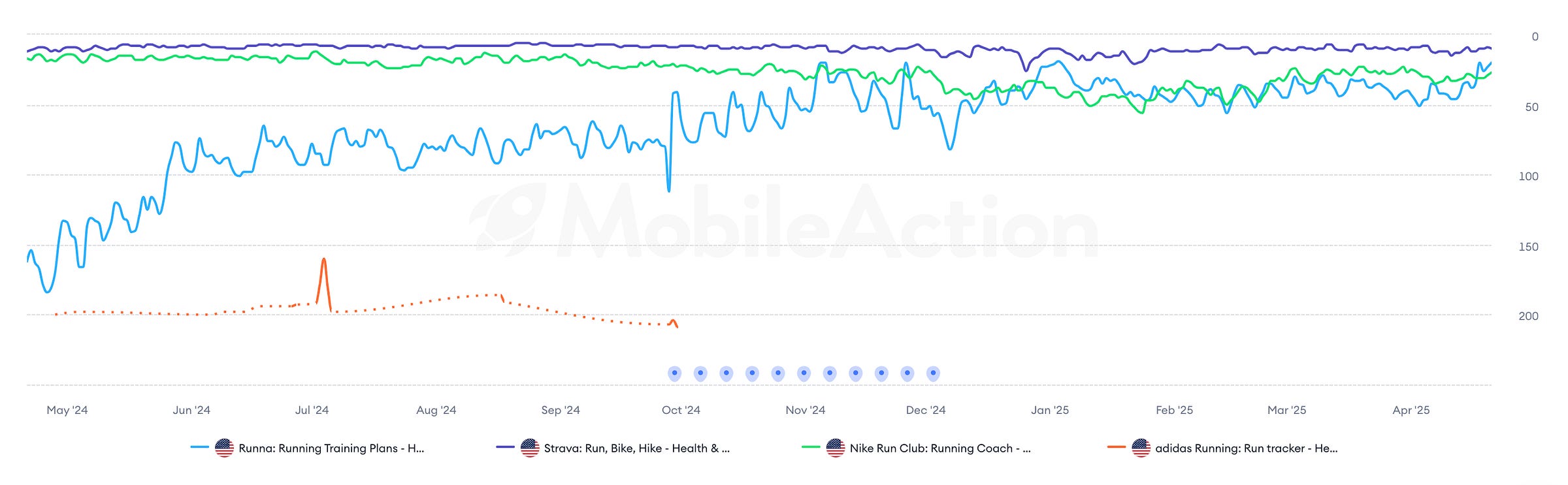

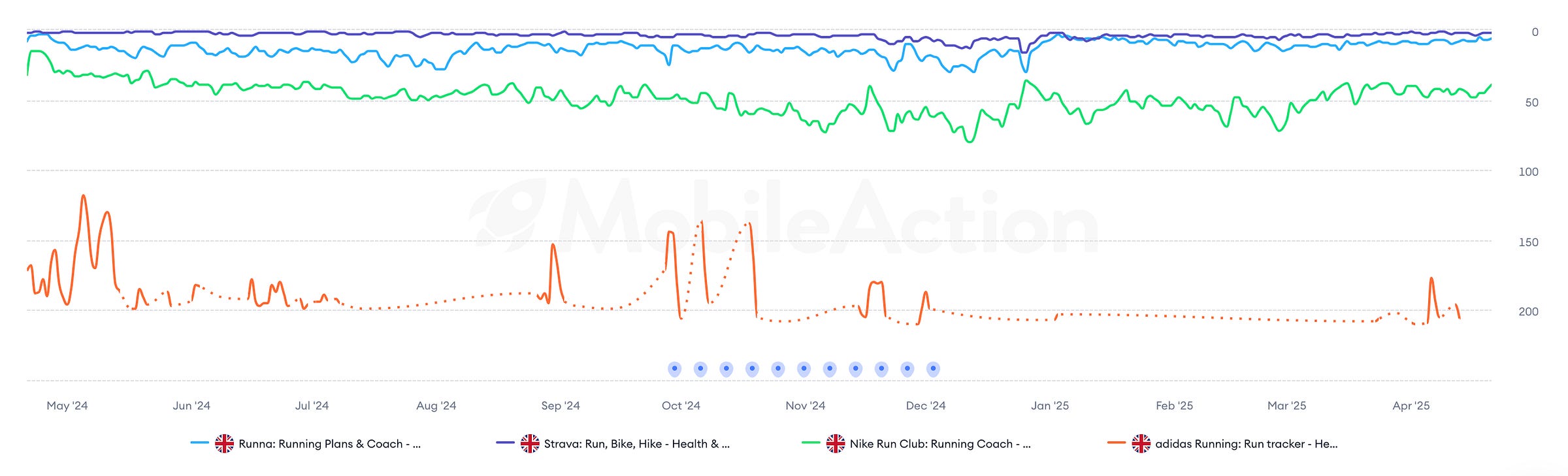

Runna’s rise has been steady. In the US, it climbed iOS category rankings throughout 2024, peaking late in the year, then briefly dropping behind Nike in March 2025, before jumping ahead again after the Strava acquisition was announced on April 17.

In the UK, it’s a different story. Runna has held a top 20 spot for nearly a year, consistently ahead of Nike Run Club, and nearly overtook Strava in January 2025.

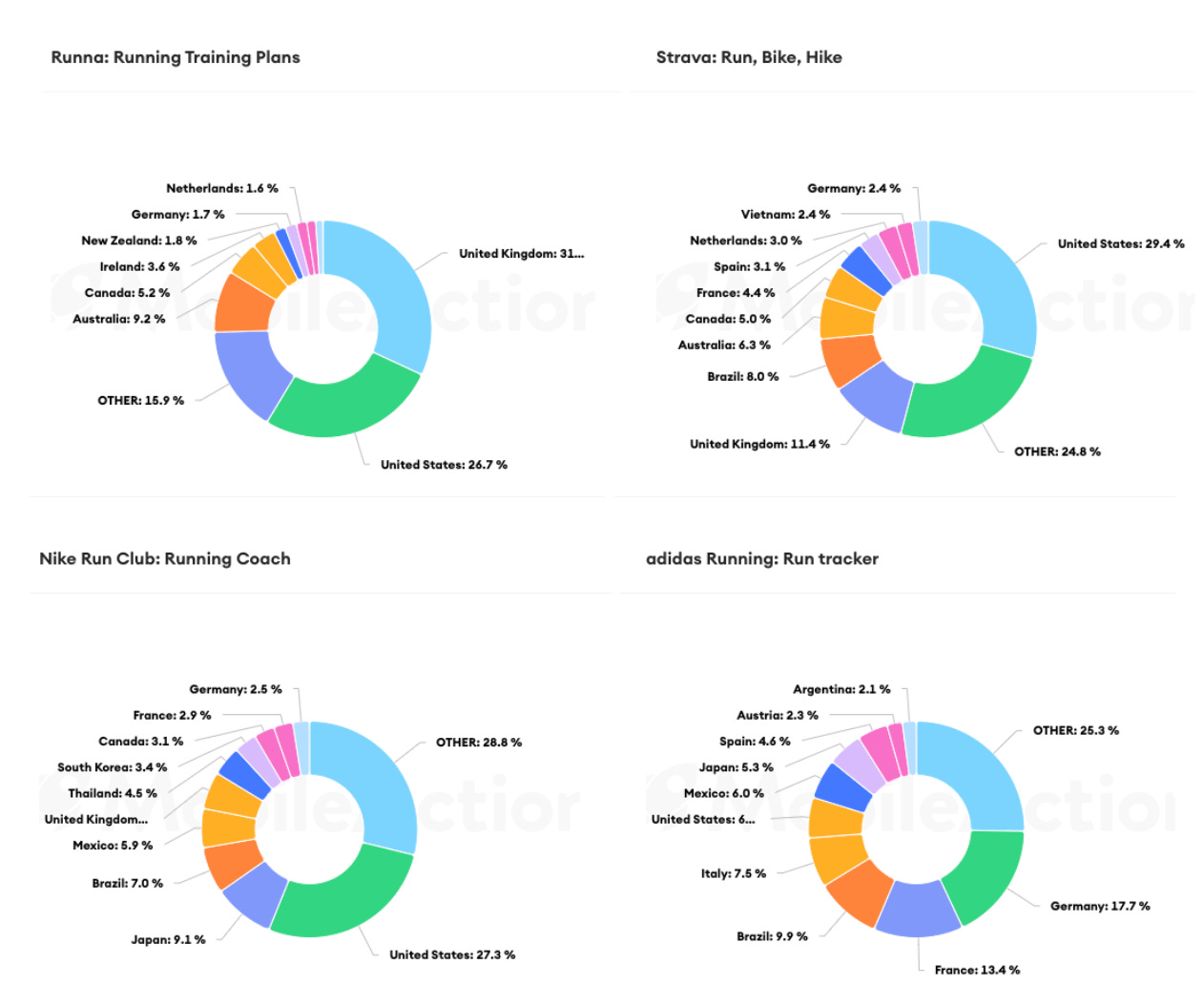

This shows Runna’s strength in English-speaking markets on iOS: the UK, US, AU, CA, and Ireland. Strava dominates the US, then the UK, Brazil, AU, CA, France, and Spain. Nike Run Club leans more into LATAM and APAC, where top markets include the US, Japan, Brazil, Mexico, Thailand, and South Korea. Adidas Running is strongest in Europe, especially Germany, France, Italy, Spain, and Austria.

So why these market differences?

It comes down to brand recognition, loyalty, feature sets, and monetisation strategy.

Features that define the Run

While all these apps serve runners, their features vary significantly.

Strava is for multi-sport athletes, offering route tracking for hikes, bike rides, and runs. Its free version includes core features like recording activities and connecting with other fitness apps. The premium tier (59.99€/year or 9.99€/month) adds smart route creation, goals, advanced insights, and top performance tracking.

Runna is focused on runners. It delivers personalized training plans based on the user’s goals, schedule, and current level, with live coaching. When users open the app, they see their daily schedule run. It offers a 1-week trial, then locks behind a paywall: 119€/year or 19.99€/month.

Nike Run Club is entirely free, offering tracking, guided runs, training plans, Apple Watch integration, community challenges, and widgets. It’s my personal favorite since all the basics are there, all free.

Adidas Running is strong in Europe and supports a wide range of activities: from running and cycling to boxing and skateboarding. Premium (9.99€/month) unlocks training plans, custom workouts, HIIT, and performance stats.

While all apps target runners, Runna stands out as the most premium: personalized, pricey, and aimed at high achievers.

Smart tactics, sharp positioning

So, why did Strava acquire Runna?

There’s a growing demand for training plans, and Runna is perfectly positioned to meet it: "43% of Strava users want to conquer a big race or event in 2025."

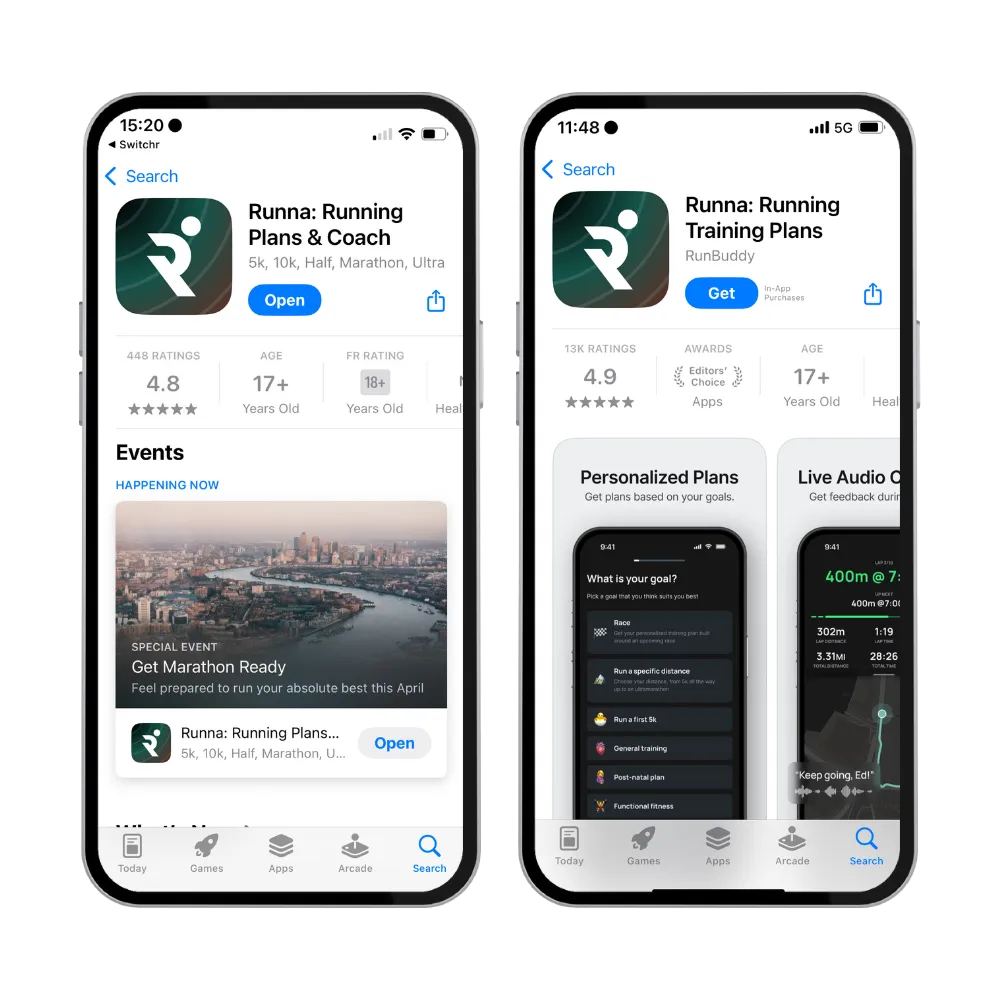

Runna carved out a niche in the App Store with smart acquisition tactics:

Keywords targeting all race levels: 5k, 10k, Half, Marathon, Ultra

Seasonal in-app events tied to race calendars

Screenshots that showcase their USP: personalised plans, live coaching

Apple Search Ads campaigns covering brand, competitor, and generic keywords

Currently, only default CPPs are live. I’d recommend running Custom Product Pages for different goals (5k vs marathon) or features (live coaching vs run tracking).

Once the user clicks through, onboarding and retention come into play.

From Trial to Runner

With this acquisition, Strava gains ground in markets where it underperformed and finally offers something it lacked: personalized running plans.

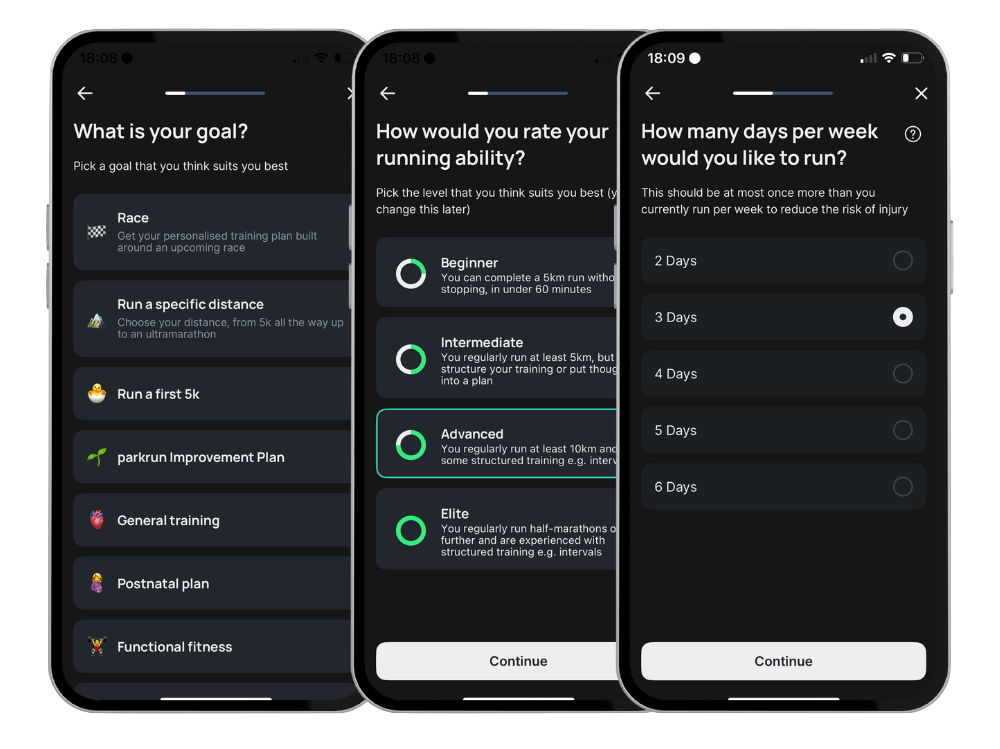

Runna’s onboarding is a quiz that assesses your goals, running level, available days, and start date. The app then builds a personalized plan with interval days, long runs, and recovery time.

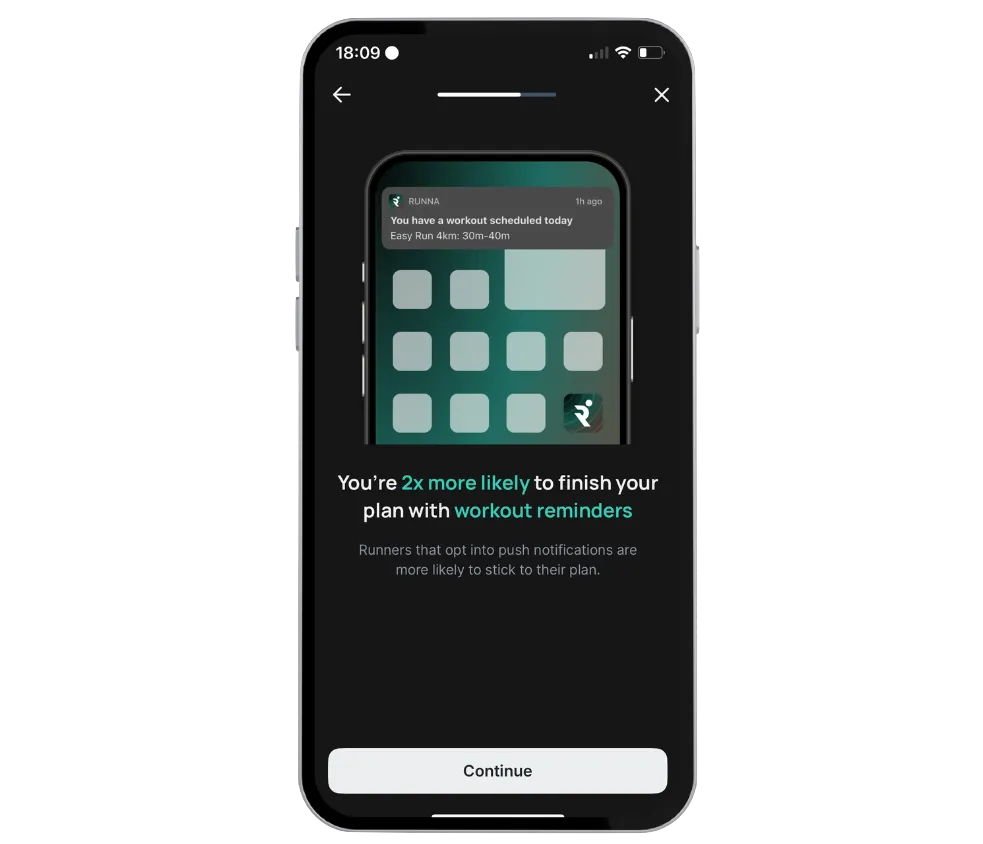

Before completing onboarding, users are prompted to enable notifications for workout reminders, strategically placed to boost opt-in rates.

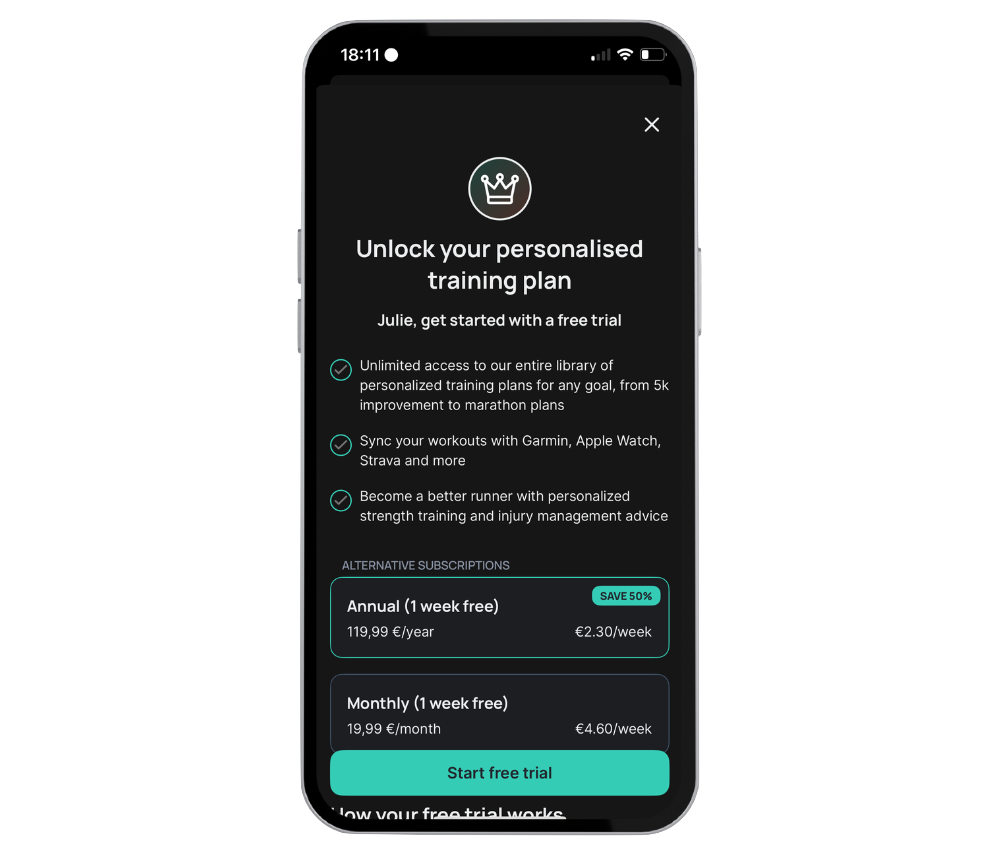

After onboarding, users start a free 1-week trial before hitting a hard paywall.

This is where Runna nails it. By the time the trial ends, users are invested.

They’ve started a plan, set goals. Quitting feels like giving up. So they subscribe, regardless of the price. That’s what I call the premium’s premium: once you’re in, you’re staying.

“The ambition is to do things where it makes sense”

– Dom Maskell, Runna CEO

We don’t yet know how this partnership will evolve, but it feels like a win-win. Both teams sound excited about creating a seamless integration.

“Runna is an amazing product, excellent team, and a strong (growing and sustainable) business. Strava is acquiring Runna for all three aspects, with the intention to support its further development and growth.” – Mike Martin, CEO, Strava.

With Health & Fitness on the rise, Strava is investing in the future of sports. In a very transparent Reddit AMA, Strava’s CEO teased : “Expect quite a bit more on this front, in the next several weeks, for both cyclists and runners.”.

Runners are sorted. Now let’s see what’s next for the cyclists. More to come...